The Problems

j

Unaffordable Benefits

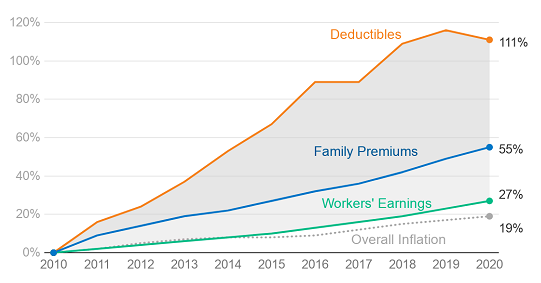

Employee deductibles have risen four times faster than worker’s earnings over the past 15 years. Premiums have risen twice as fast as earnings and almost three times the rate of inflation.

More and more employees are delaying or completely foregoing needed medical care because they simply can’t afford it, even when they have insurance.

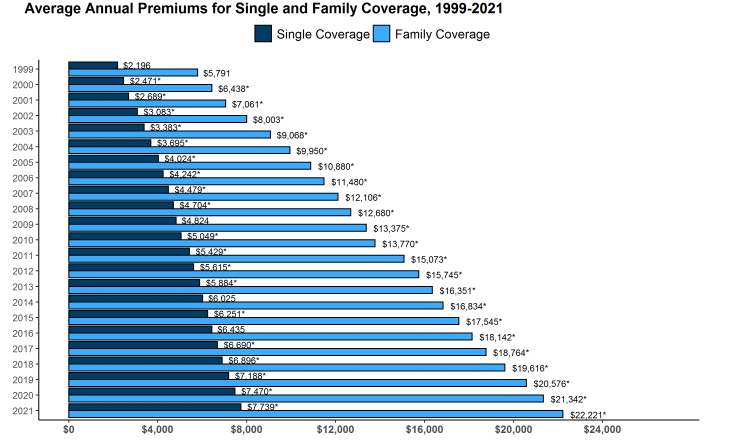

Ever-Rising Premium

It now costs more than $22,000 per year to cover a family with health insurance, and each year companies are paying more and more just to provide the same, or lesser coverage to employees.

Health benefits are now a top company expense for organizations in every industry.

157 million Americans rely on employer-sponsored coverage, and these trends are simply unsustainable. When will your company decide to do something different?

How We Solve These Problems

High Plains Health Plan partners with leading hospitals, primary care practices, surgery centers, physicians, pharmacies, and other health care providers DIRECTLY on behalf of companies and their employees. This empowers your organization to have more control and flexibility with your plan to help your employees receive high-quality, affordable care when they need it. With the savings we are able to generate, we also reward employees with valuable benefits, such as $0 Deductibles, Copays, and out of pocket costs for thousands of health care services.

Leveraging Technology And Analytics

Healthcare data analyses and predictive analytics can identify patients at higher risk of developing chronic conditions and help healthcare providers intervene early with preventative measures and targeted treatments. This can improve patient outcomes and reduce overall costs, while also streamlining your healthcare operations and improve efficiencies. Predictive analytics is revolutionizing healthcare for employers who are looking to better manage healthcare costs.

20% Average Cost Savings

Better Quality Benefits

Six Plan Designs

National PPO Network Access